July 26th, 2018

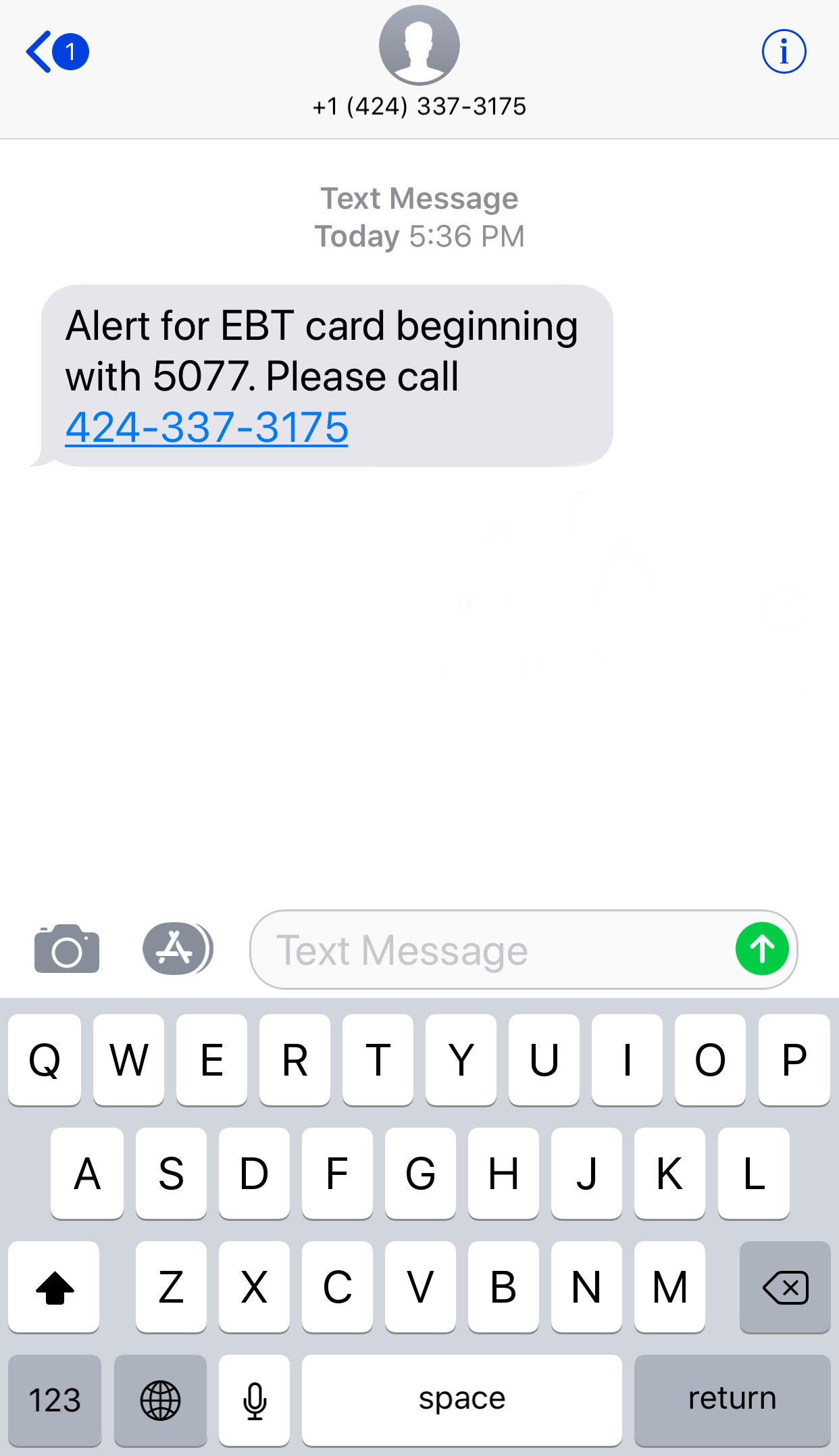

Today's newsletter is based on something that happened to me earlier today. Around 5:30pm, I got this text on my phone:

I occasionally get contacted by the bank or the credit agency asking me to contact them when there's a security flag on any of my credit or debit cards. So, at first blush, this text wasn't unusual. So I didn't hesitate t…